How Fintech is Serving Users Who Are Self-Employed

Photo by André François McKenzie

Disclaimer: The views expressed in this article belong to an independent guest author and not Leaderonomics, its directors, affiliates, or employees. This is not financial or investment advice. Please do your own research and evaluate your risk appetite before investing.

When it comes to leadership and entrepreneurship, few industries are opening new possibilities for young entrepreneurs than the financial tech sector. Today, fintech has made a significant impact on digital businesses in terms of cash flow, compliance, security, efficiency, customer experience, and more.

Read more: Let’s Go Back To The Basics Of Financial Literacy, Shall We?

Some fintech companies have even focused on serving self-employed and gig economy workers. In this article, we're going to take a look at how fintech is serving the self-employed, and what that means for future self-employed business owners.

How fintech has benefited the self-employed.

For starters, fintech has vastly improved the ways online business owners can accept payments. For example, companies like Paypal and Wise allow you to store money in your account and pay for goods and services with it, using either ACH debits or digital debit cards.

However, fintech has also opened the door for other payment methods, such as mobile e-wallets, peer-to-peer cash transfers, or even bitcoin.

In addition to online payment methods, many fintech companies are helping to secure digital transactions by connecting with financial institutions that offer protection for businesses.

In the old days, website owners needed to securely implement checkout processes and most likely had to rely on payment processors like PayPal to offer their customers the best protection. Today, however, many fintech companies are securing payments for customers in-house, offering all the protections of a traditional bank with the speed and flexibility of an online payment system.

This means that business owners can easily accept a variety of payment methods, offering multiple options to consumers at the checkout page. For instance, Square has integrated with Apple Pay and Google Pay to make it easy for customers to pay with their smartphones. This is an example of the business-to-business (B2B) opportunity.

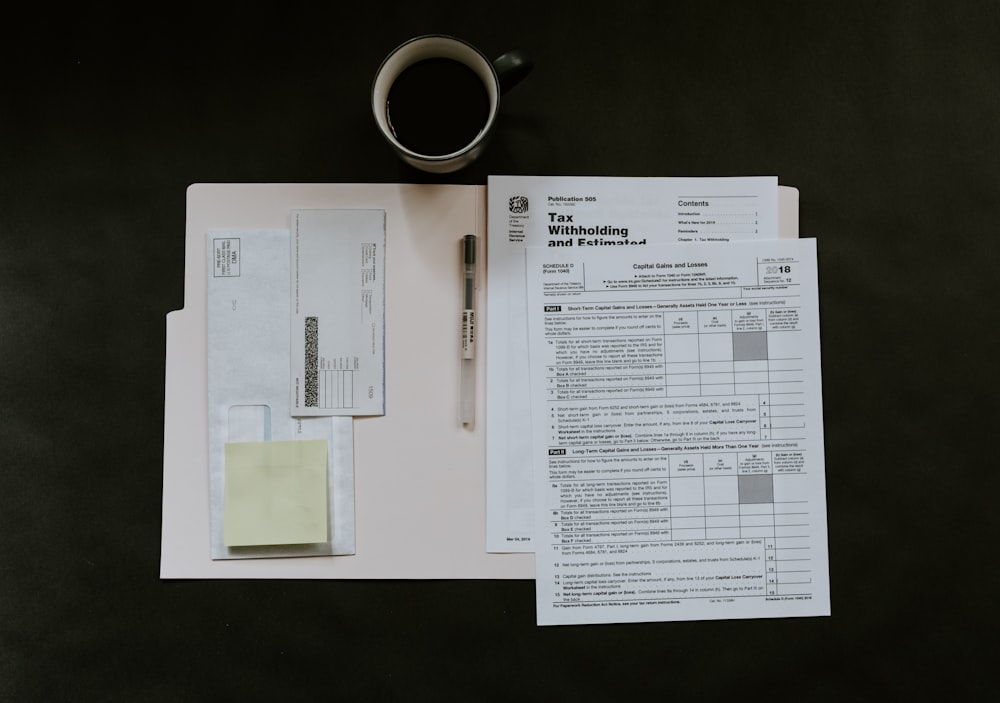

Fintech has also made taxes easier.

In recent years, the IRS has been cracking down on the freelance economy, taking a much more stringent approach to tax reporting. While online freelancing used to be an easy way to earn money "under the table", popular freelance platforms like Upwork are required to report your earnings, and the IRS has stepped up to make sure these freelancers and gig economy workers are paying their fair share.

This also holds true for digital payment platforms like PayPal - in fact, all US payment processors are required to provide information to the IRS on account holders, and their cash flow.

Of course, properly filing your taxes as a freelancer, independent contractor, or small business owner (such as an LLC) is a daunting task that takes a lot of time and planning. Some of the largest tax filing services, like TurboTax, are more geared towards W-2 wage earners, and are a bit trickier to navigate when you're reporting self-employed income.

This is where services like the 1099 tax calculator by KeeperTax come into play - they provide a comprehensive series of tax calculators, specifically geared towards entrepreneurs and freelancers, that give you a concrete calculation for your taxes, and making filing a much less stressful process.

Ultimately, fintech has made paying taxes for self-employed individuals much easier and more streamlined.

Fintech has enabled beginner investors to dip their toes in stocks.

Investing in the stock market used to be a daunting task. Things like stockbrokers, portfolio managers, and multi-level marketing (MLM) companies all required a great deal of trust in your stockbroker - and even purchasing stocks was complicated.

Today, however, this is almost non-existent. The rise of the DIY investing trend has largely been driven by a number of online stock trading platforms, many of which have simplified the process of buying and selling stocks for newbies. For instance, people can now purchase or sell the TSM stock just by using an online trading platform.

Today's robo-advisor services are specifically designed for experienced investors - they do the hard work of analysing companies and generally form the core of your investment plan.

If you're feeling really dangerous, some platforms even let you purchase stocks with cryptocurrency, which would allow you to diversify your portfolio easily. Some platforms would even show you intuitive data visualisations and automated stock analysis to help you understand a stock's fundamentals within minutes. You could, for example, buy crypto during a dip, then liquidate your crypto for stocks when the inverse is true.

Fintech enables more entrepreneurs to secure small business loans.

Startup capital is a significant part of a small business' runway, and financing is one of the largest challenges faced by any small business owner.

If you're thinking of starting your own business, a major factor in your decision is whether or not you can secure funding to take your business to the next level. Online loans from platforms like Giggle Finance, Reggora, OppFi, Earnest, and many others you can compare, provide access to small business loans at reasonable rates and terms.

Thanks to online tools like these, securing a small business loan is easier than ever, and easier to pay back as well - an important factor when your business depends on your capital.

Fintech lenders will often use additional metrics that traditional lenders often overlook, such as rent payments and utility bills, to better evaluate creditworthy borrowers. In addition, small business borrowers can often lock in long-term fixed interest rates and fees with online lenders, which keeps your business loan from rising over time. Having a modern financial tool will allow you to keep track of these loans and make the payments on time to keep your small business going

While fintech lenders mainly cater to larger SMEs (small to mid enterprises), many are also willing to work with startups that are in need of some funding, or maybe just need a bit of guidance getting started.

Final words

Overall, fintech has facilitated a wide variety of important improvements that have benefited the people and small businesses directly affected by it. This doesn't mean traditional banking is out of business, far from it: it simply means that fintech is incredibly efficient at meeting the needs of users that are searching for new, more efficient services, whether they are small business owners, freelancers, professionals, or ordinary folks.

Most fintech platforms are partnered with banks themselves, such as platforms that allow users to store their money on the individual fintech app - technically, your money is being held by the partner bank of the fintech company.

This may interest you: Does Every Company Need To Be A Technology Company?

However, fintech apps are able to bridge the gap between convenient banking services and consumers, by offering consumer-friendly, cost-effective services, utilising cutting-edge technologies such as blockchain, artificial intelligence, machine learning, and more.

Check out the media below:

Leaderonomics.com is an advertisement free website. Your continuous support and trust in us allows us to curate, deliver and upkeep the maintenance of our website. When you support us, you allow millions to continue reading for free on our website. Will you give today? Click here to support us.

Business

This article is published by the editors of Leaderonomics.com with the consent of the guest author.